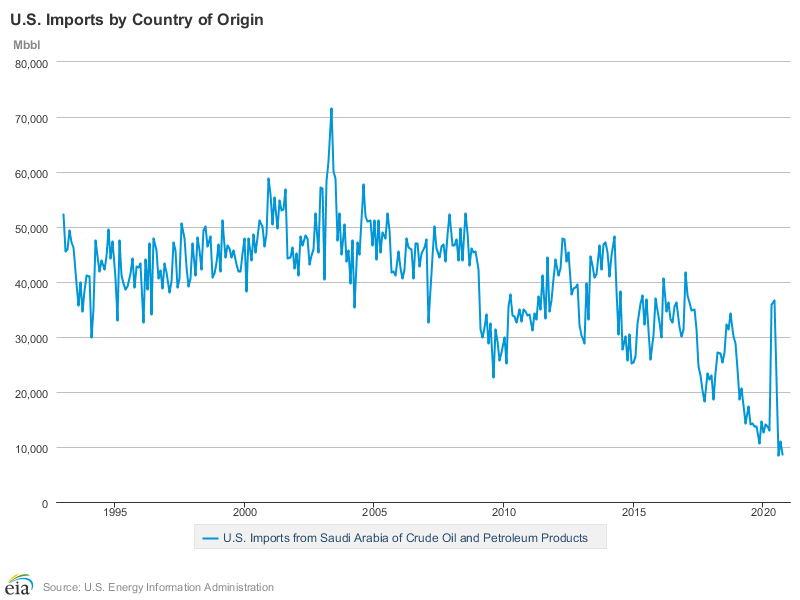

The United States didn’t import any Saudi crude last week for the first time in 35 years, a reversal from just months ago when the Kingdom threatened to upend the American energy industry by unleashing a tsunami of exports into a market decimated by the pandemic.

The last time there were no Saudi imports was in 1985, during Ronald Reagan’s presidency. Since then, every administration has at least attempted to eliminate America’s reliance on Middle East oil.

Just 12 years ago, during the Obama administration’s first term, American refiners were routinely importing about 1 million barrels a day of crude from Saudi Arabia, the second-largest supplier to the US after Canada and seen as a major security risk.

Three presidential terms later, that flow has fallen to zero. It is the most visual manifestation of how little America now relies on Middle East oil, after shaping its foreign policy for decades around its need for crude. If this abstinence from Saudi oil continues, it would weaken the economic, political and military links that have defined relations between Riyadh and Washington for decades.

Earlier this week, OPEC and its allies reviewed their production plans, allowing small increases for Russia and Kazakhstan in February and March, with the rest keeping production unchanged. Then Saudi Arabia surprised even its fellow producers by announcing a unilateral cut to its own production of a further 1 million barrels over the next 2 months. The OPEC leader’s decision caused global benchmark Brent oil futures prices to surge beyond US$54 a barrel.

“While the US imports of Saudi oil hitting zero is historic, its likely this is temporary and and only an aberration given the current low refinery runs and deep Saudi production cuts that are going to increase, against the backdrop of the ongoing pandemic environment,” said Karim Fawaz, Director of Research and Analysis for Energy at IHS Markit.

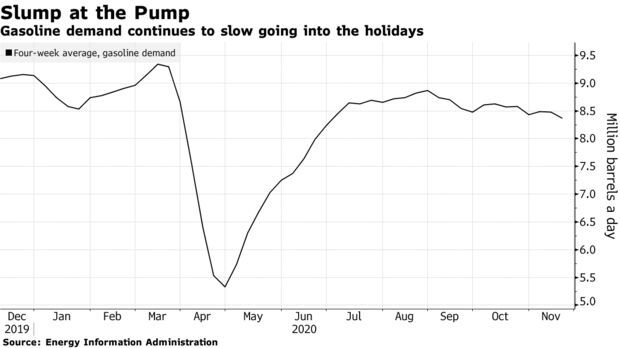

America is still in the throes of the pandemic, with record infections in many states forcing new restrictions, while some other parts of the world are recovering. US gasoline consumption plunged to the lowest in years during the usual high-demand Thanksgiving and Christmas holiday periods.

The demand loss is so acute some US refineries have been idled. “Throughput is still below where it was before the crisis because of reduced domestic demand. So why send more here when Asia is where recovery has been clear,” said Sandy Fielden, director of oil and products research at Morningstar Inc.

For Saudi Arabia, cutting shipments to the US is the quickest way to signal to the wider market that it’s tightening supply. The government is alone in publishing weekly data on crude stockpiles and imports, which carry enormous influence among oil traders. Other big petroleum consuming nations, like China, publish less timely information about oil supplies.

In May and June, Saudi deliveries to the US more than doubled from a year ago in the aftermath of a bitter price war with Russia. The onslaught prompted Senator Ted Cruz, a Texas Republican, to tweet in April: “My message to the Saudis: TURN THE TANKERS THE HELL AROUND.” American refiners received the final installment of that bumper load in early July.

Since then, Saudi oil shipments to the US have steadily declined. In November and then again in December, they delivered only 73,000 barrels a day to customers, preliminary US Energy Information Administration data show.

In the short term, the election of Joe Biden could benefit Saudi Arabia. While transitioning away from hydrocarbons would have a long-term impact on oil demand, hopes to revive the 2015-Iranian nuclear deal would pave the way for more Iranian oil to flow globally. “Those sales will displace Saudi oil and that would mean Arabia would have to turn to the US to maintain sales,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston.