By Eric Yep

Singapore’s journey from an international oil and refining hub, that has been core to its economy for decades, to a new energy future, has kicked off in earnest. A slew of announcements at Singapore International Energy Week 2021 included plans to have around 30% of Singapore’s electricity supply from low-carbon electricity imports by 2035.

The regulator Energy Market Authority plans to invite proposals for the supply of up to 4 GW of low-carbon electricity imports into the country by 2035, as part of efforts to decarbonize the power sector.

Singapore is working on a long-term plan to decarbonize its electricity supply that combines natural gas, low-carbon electricity imports, renewables, and low-carbon alternatives like hydrogen and technologies like carbon capture, utilization and storage, which can reduce carbon emissions from fossil fuels, EMA said.

By 2028, Singapore will boast the world’s largest subsea power interconnector, a 4,200 km undersea cable carrying solar power from Darwin in northern Australia to Singapore, to meet around 15% of the city-state’s total power supply.

Low-carbon electricity imports include 100 MW of electricity from Peninsular Malaysia via the existing interconnector expected to commence in early-2022; a pilot project to import 100 MW of non-intermittent electricity from a solar farm in Pulau Bulan, Indonesia, by around 2024; and 100 MW of power from Laos via the Laos-Thailand-Malaysia-Singapore Power Integration Project, among others.

Singapore could also introduce green hydrogen into its energy mix in less than five years.

Sembcorp Industries, with a power generation portfolio of over 12,800 MW across Asia, of which more than 3,300 MW is renewable energy, signed a memorandum of understanding in October with Japan’s Chiyoda Corp. and Mitsubishi Corp. to set up a commercial-scale supply chain to deliver decarbonized hydrogen to Singapore, making it one of the first utilities in the city-state to move forward on the new fuel source.

The partnership will utilise Chiyoda’s hydrogen storage and transportation technology in which methylcyclohexane or MCH will be the liquid organic hydrogen carrier.

The selection of the MCH route is significant because other green hydrogen exports from places like Qatar have opted for liquid hydrogen, while other exporters in the Middle East are exploring ammonia-based options.

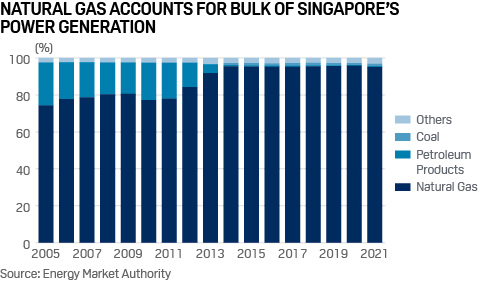

Singapore Power Generation Mix

Power generation is the second-largest contributor to Singapore’s carbon emissions after the industrial sector, accounting for around 39% of total emissions, according to government data. Nearly 95% of Singapore’s power generation comes from natural gas.

Eventually, decarbonizing power will involve diverse solutions ranging from importing renewable electricity to hydrogen. In the interim carbon-neutral LNG will allow importers to select the supplier with the least carbon footprint, which is why Pavilion Energy has asked its gas producers to provide a full statement of their greenhouse gas emissions.

Pavilion Energy, backed by state investment group Temasek Holdings, was the first to import a carbon neutral LNG cargo in April. It plans to build an emissions business that taps carbon offsets initially to drive decarbonization across the LNG value chain, its interim chief executive, Alan Heng said recently.

But he has also warned that renewables are not yet ready to assume a greater and more stable role in the global energy mix. Pavilion’s concerns were echoed by Tellurian’s Martin Houston at the S&P Global Platts Asia LNG & Hydrogen Conference, who said there was “clearly a conflict between our need to decarbonise and the way we’re going about it on a global basis.”

“If we demonise this industry much more and if we take away the capital in the industry, we will cut supply, demand will continue to increase and ultimately the lights will go out,” he said.

Most conference panelists were realistic about their expectations from carbon-neutral LNG as well, pointing out that it’s an interim and partial solution until more advanced technologies like CCS are proven, and can only serve as a last resort after all other abatement options have been fully utilized.

Initiatives Will Be Pulled Together Under A Carbon Marketplace

Singapore’s carbon market, expected to launch by the end of 2021, could potentially play a vital role in overhauling the voluntary carbon market, which is fragmented and often criticised for not being robust enough to meet what is a lofty goal—to cap the world’s CO2 emissions.

The initiative called Climate Impact X or CIX is backed by state investor Temasek Holdings, one of the world’s largest investment portfolios, DBS Bank, the Singapore Exchange and Standard Chartered.

With Singapore ready to import electricity from Australia, conversations around a wider marketplace for trading carbon and Guarantees of Origin are already happening between the countries. Australia’s proposed carbon exchange is expected to start by 2023.

Both Singapore and Australia are working towards driving climate initiatives in Southeast Asia and the Pacific region.

COP26 saw Australia doubling it climate funding support for the region to A$2 billion (about US$1.5 billion) and pulling in Fiji and Papua New Guinea into its Indo-Pacific Carbon Offsets Scheme, which is modelled on Australia’s domestic carbon market called Emissions Reduction Fund, to develop a carbon offset scheme in the Indo-Pacific region.

![[Latest] Global Data Center CPU Market Size/Share Worth USD 48.9 Billion by 2033 at a 15.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)](https://energy.asia/wp-content/uploads/2024/12/global-data-center-cpu-market-2024-2033-by-billion--120x86.png)