Massive 14-megawatt wind turbines are set to become commercially available from 2020 onwards, furthering clean energy’s push for larger and more efficient facilities. Analysis by Rystad Energy shows that although they are more expensive to manufacture, these giant turbines actually reduce overall costs for large-scale offshore wind farms.

Their added costs are expected to be mitigated by fewer required units and the efficiency gains associated with the newer, more technologically advanced turbines. For every project, there is also the cost of manufacturing a number of foundations, so the reduction in the number of turbines will also lead to fewer array cabling runs, which in turn reduces the installation scope.

Analysis was done using the cost of using turbines of differing sizes for the case of a 1 gigawatt (GW) offshore project. The most current models, the SG 14-222 DD developed by Siemens Gamesa will leapfrog GE’s new 12 MW Haliade-X prototype and become the largest turbine available, globally. At the moment, the largest turbines to be commissioned between 2020 and 2021 have nameplate capacities of up to 10 MW.

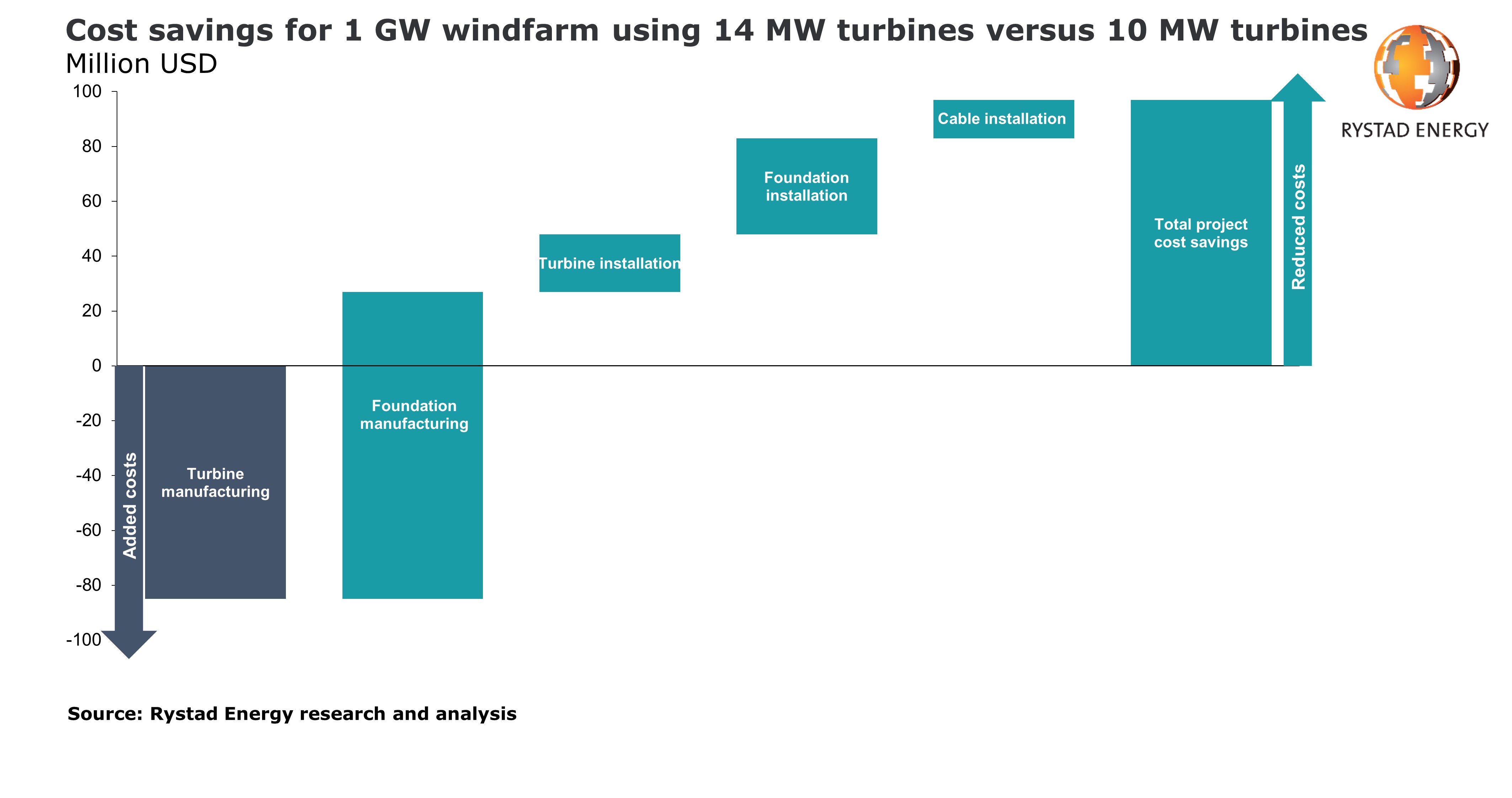

Utilizing 14 MW turbines instead of 10 MW ones, the number of units required for a 1 GW project falls by 28 units, from 100 to 72. Moving to a 14 MW turbine from a 12 MW turbine still offers a reduction of nearly 11 units. Overall, the analysis shows that using the largest turbines for a new 1 GW windfarm offers cost savings of nearly US$100 million versus installing the currently available 10 MW turbines.

“Siemens Gamesa’s newest turbine is a step towards dramatically reducing development and levelized costs world-wide. With larger turbines come greater savings in other project segments and greater revenue generation potential over the duration of future projects, increasing the offshore wind industry’s competitiveness,” says Rystad Energy’s product manager for offshore wind, Alexander Flotre.

In this example, it is assumed that the cost of a turbine is approximately US$800,000 per MW on average for currently available units (i.e. turbines with up to 10 MW nameplate capacities), with a 2.5 percent premium applied for each additional MW for the larger units expected in the medium-term, to reflect anticipated efforts by manufacturers to capture upside.

Thus, for this analysis it is estimated that the cost of a 10 MW turbine is US$8 million, while a 12 MW and a 14 MW turbine would cost approximately US$10.1 million and US$12.3 million, respectively. Therefore, moving from a 10 MW turbine to a 14 MW turbine could result in higher costs of approximately US$85 million for manufacturing, while utilizing a 14 MW turbine in lieu of a 12 MW unit could add almost US$45 million to manufacturing costs.

Foundations are the main components that offer opportunities for cost reductions if larger turbines are utilized. It is estimated that a foundation typically costs between US$3 million and US$4 million, with variations relating largely to foundation type and water depth. In a 10 MW to 14 MW switch, such cost savings could surpass US$100 million for the developer, while savings in a 12 MW to 14 MW scenario would likely range from US$30 million to US$50 million.

The cost of array cables varies based on the turbine size. While the use of larger turbines implies potential cost savings through fewer foundations, the added length required for array cables for 14 MW turbines is likely to keep overall cable costs flat. However, the lower turbine count reduces the number of cabling runs and connection of turbines to the offshore substation, which in turn could cut installation costs.

This example shows that while larger units are expected to drive up the cost of turbines, reductions from other segments – namely foundations – could result in cost savings of US$100 million to US$120 million on manufacturing alone, helping to offset some of the developer’s expenses.

Rystad Energy also estimates that the cost to install a turbine ranges between US$0.5 million to US$1 million, while the cost of foundation installation ranges from US$1 million to US$1.5 million per unit. Using the midpoint in each range, for a 1 GW project the implied savings surpass US$50 million if using 14 MW instead of 10 MW units. Under similar circumstances but comparing 14 MW against 12 MW turbines, potential savings are beyond US$20 million. Furthermore, the reduction in cabling runs and connections due to the lower number of array cables could lead to additional savings of between US$5 million and US$15 million when using 14 MW turbines rather than 12 MW and 10 MW turbines.