In its most recent World Energy Transitions Outlook, the International Renewable Energy Agency (IRENA) estimates that accelerating energy transitions on a path to climate safety can grow the world’s economy by 2.4% over the expected growth of current plans within the next decade.

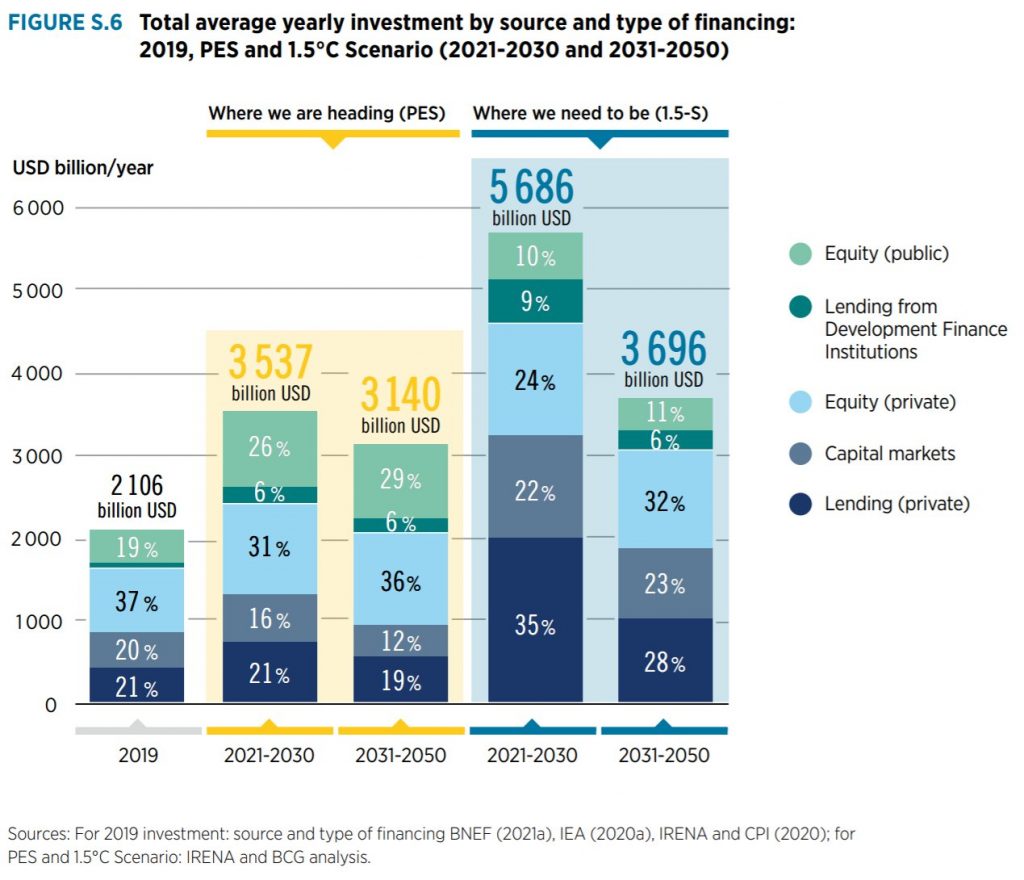

According to the document, the initial investments required to move into a cleaner future have been estimated at $131 trillion needed through 2050 to boost efficiency, renewables, end-use electrification, power grids, flexibility, hydrogen and innovations.

“While the annual funding requirement averaging at $4.4 trillion is large, it represents 20% of the Gross Fixed Capital Formation in 2019, equivalent to about 5% of global Gross Domestic Product,” the report reads.

Despite initial investments being large, the agency’s calculations show that when air pollution, human health and climate change externalities are factored in, the payback is even higher with every dollar spent on the energy transition adding benefits valued at between $2 and $5.5 trillion, in cumulative terms between $61 trillion and $164 trillion by the mid-century.

“IRENA’s Outlook sees energy transition as a big business opportunity for multiple stakeholders including the private sector, shifting funding from equity to private debt capital,” the report reads. “The latter will grow from 44% in 2019 to 57% in 2050, an increase of almost 20% over planned policies. Energy transition technologies will find it easier to obtain affordable long-term debt financing in the coming years, while fossil fuel assets will increasingly be avoided by private financiers and therefore forced to rely on equity financing from retained earnings and new equity issues. Capital-intensive, more decentralized projects will influence investors’ risk perception, which in turn may need targeted policy and capital market interventions.”

In addition to the role of private investing, the report states that public financing will remain crucial for a swift, just and inclusive energy transition and to catalyze private finance.

The agency’s numbers show that in 2019, the public sector provided some $450 billion through public equity and lending by development finance institutions but under IRENA’s 1.5°C Scenario, these investments will almost double to some $780 billion. Public debt financing is also seen as an important facilitator for other lenders, especially in developing markets.

The group’s data also show that current government strategies already envisage significant investment in energy amounting to $98 trillion by 2050. These investments imply a near doubling of annual energy investment, which in 2019 amounted to $2.1 trillion.

“Substantial funds will flow towards modernization of ailing infrastructure and meeting growing energy demand. But the breakdown of financing for technology under the 1.5°C Scenario differs greatly from current plans: $24 trillion of planned investments will have to be redirected from fossil fuels to energy transition technologies between now and 2050,” the review states.

The role of government is also considered key to pushing markets towards the new green world, which means that policymakers are encouraged to incentivize but also take action to eliminate market distortions that favor fossil fuels and facilitate the necessary changes in funding structures.

“This will involve phasing out fossil fuel subsidies and changing fiscal systems to reflect the negative environmental, health and social costs of fossil fuels,” the report reads. “Monetary and fiscal policies, including carbon pricing policies, will enhance competitiveness and level the playing field. Such interventions should be accompanied by a careful assessment of the social and equity dimensions to ensure that the situation of low-income populations is not worsened but improved.”

Policies that work towards the enhancement of international cooperation are also considered critical to driving the wider structural shift towards resilient economies and societies.

In IRENA’s view, if not well managed, the energy transition risks inequitable outcomes, dual-track development and an overall slowdown in the progress.

![[Latest] Global Data Center CPU Market Size/Share Worth USD 48.9 Billion by 2033 at a 15.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)](https://energy.asia/wp-content/uploads/2024/12/global-data-center-cpu-market-2024-2033-by-billion--120x86.png)