When it comes to Electric Vehicle manufacturing, few resources are as vital as Lithium. Over the past decade, prospectors unearthed troves of the Lithium chemicals that power batteries, but the shift toward a cleaner economy is accelerating and batteries play a central role.

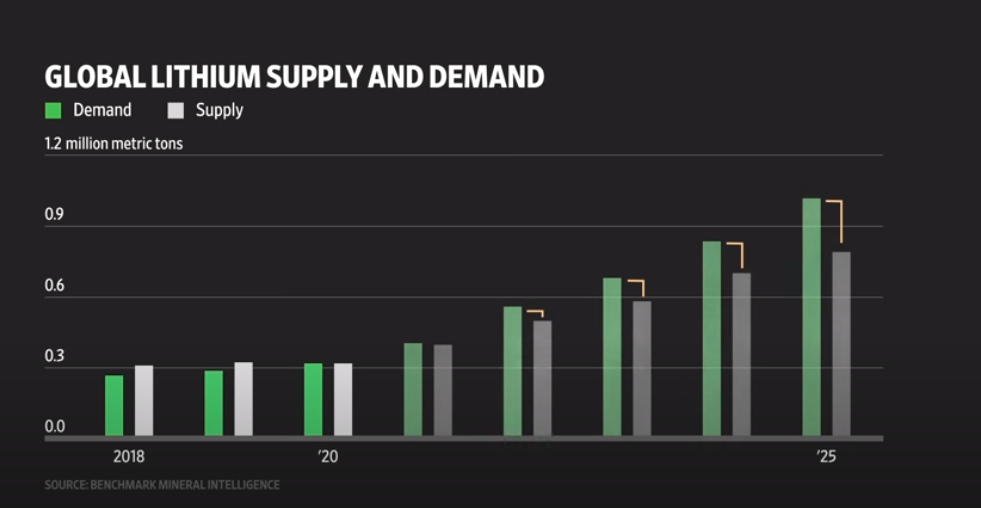

As a result, demand for Lithium is expected to exceed supply through 2025.

Car makers and analysts say that more Lithium is needed to produce more batteries at a faster pace.

As China takes a leading role in the battery supply chain, The U.S. government is trying to boost domestic supply of the metal.

Here’s how Lithium became such a hot commodity.

Lithium is scattered not only across The U.S. but the entire world. In the top Lithium producing country, Australia, miners excavate a mineral called spodumene, which contains the metal.

In Chile and Argentina, companies extract Lithium from massive salt lakes by pumping water into the ground. The extracted metals are mixed with other elements to produce compounds like Lithium Hydroxide and Lithium Carbonate.

These compounds are a key part of many batteries. Car makers and battery researchers value Lithium because of its unique chemical properties.

With Lithium Ions being so small, they can be very easily recharged, as they diffuse quickly during battery charge and discharge. They are also very light weight, so batteries based on Lithium Ions can offer high energy, meaning that a lot of energy can be packed in a small amount or small volume of materials.

These two properties, energy density and rechargeability are the reason why Lithium is found in so many batteries. Inside of all batteries are two major components, the cathode and the anode, compounds that contain Lithium Ions transfer from one components when power is drawn down and they return when the battery is recharging.

They can be charged like hundreds or thousand of times so they have different kind of degradation mechanism. But Lithium Ions are so small, so they are very stable. That’s the reason why the Lithium Ions can offer at least a few years of use.

Scientists have spent decades perfecting Lithium based batteries. Lithium was discovered in 1817, but more than a century passed before businesses used the chemical in mainstream batteries.

In the 1990s, Sony took advantage of new, lightweight Lithium Ions batteries in a design for a hand-held video camera. The result was the Handycam, a smash commercial hit!

Shortly afterward, rechargeable batteries began to appear in laptops and smartphones. And batteries are increasingly used in conjunction with wind and solar power.

Analysts point out that the demand for the chemical is growing as companies build bigger, battery-powered machines.

People need more Lithium today and in the future than in the past, because you are going from Lithium Ion batteries the size of your mobile phone to Lithium Ion batteries the size of your car. The entire chasse of an electric vehicle is a Lithium Ion battery. So there’s an order of magnitude bigger and as a result you need an order of magnitude more Lithium supply.

This means mining companies around the world are searching for Lithium. The search is based on expectations of consumer demand for electric vehicles.

It takes 4 to 7 years to build a Lithium mine, it takes 24 months to build a battery plant. These two parts of the supply chain, they don’t live in the same time zones. And that is the major challenge, matching supply when the demand is needed and at present, the industry has really failed to date.

Even tough EV sales currently make up about 2% of the U.S. Auto Market, that share is expected to grow to 10% by 2025, according to Morgan Stanley. Policies coming out of Washington could further boost demand for battery components.

U.S. President Biden ordered a review of domestic supply chains for critical products. That includes semiconductors, key minerals, pharmaceuticals, and advanced batteries like the ones used in electric vehicles.

The president’s emphasis on supply chain is driven in part by geopolitics. When it comes to Lithium, only about 1% of global output is both mined and processed in The U.S., China unearths about 10%. China also processes about two thirds of the worlds Lithium supply, and dominates the global battery market.

The U.S. government has said that relying on oversea sources for these materials creates a strategic vulnerability, which means a new hunt for Lithium is only getting started.

The race is on to see who will supply the world with this powerful metal.

![[Latest] Global Data Center CPU Market Size/Share Worth USD 48.9 Billion by 2033 at a 15.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)](https://energy.asia/wp-content/uploads/2024/12/global-data-center-cpu-market-2024-2033-by-billion--120x86.png)